Insurance is, or should be, black and white (aka not complicated) too… Should you try comparison shopping with the Zebra? They refer to it as “insurance in black and white.” Get it? Zebras? They’re black and white.

This is simpler than going through the quote process multiple times for multiple different insurers, and it produces fairly accurate quotes based on your personal information. It showed the monthly price of coverage, and once you hit “confirm now,” it shows a little more detail about the auto insurance policy and pricing.Īssuming you want to move forward, you can select the Z ebra auto quotes that appeal to you and secure an auto policy almost immediately online or with one of their licensed insurance agents. I was presented with 6-7 auto insurance quotes in each category, along with some others that just said “get quote.” This is how you get personalized quotes from the Zebra. Then there are additional coverage options like GAP insurance and roadside assistance.

You’ll have to decide whether the state-mandated liability insurance (consisting of bodily injury liability and property damage liability coverage) is enough coverage for you, or if you need to add options like collision and comprehensive coverage. How do you find the right auto insurance coverage for your needs?Įssentially, the more coverage you want/need, the higher the category, and the higher the price. You’ll see four main coverage levels, including minimum coverage, basic, better, and best so you can choose the right level of coverage for your needs. They also list several car insurance companies that don’t provide Zebra auto insurance rates, which ostensibly require you to visit their individual website for pricing. Obviously, no one would charge for this, right?

ZEBRA INSURANCE FREE

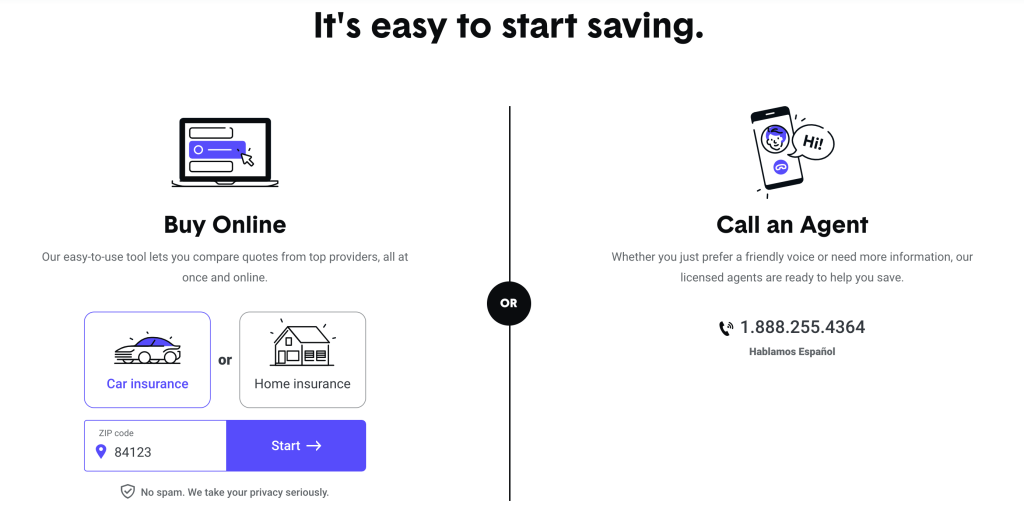

Next, they provide you with instant Zebra auto insurance quotes from “dozens” of “top insurance companies” free of charge. The car insurance discounts that appear on Zebra are populated based on your answers to give you more accurate pricing. Most major insurance companies offer multiple auto insurance discounts. Secured with SHA-256 Encryption How can you unlock discounts on the Zebra?Īs you can see, I was able to get “currently insured” and “low mileage” to appear, along with several others. You can go back and edit these details if you wish, and your answers will unlock certain discounts. Generally speaking, those with excellent credit and a clean driving record will have the easiest time finding cheap car insurance. This is because auto insurance providers consider factors like your age, marital status, gender, credit score, and driving record when setting your auto insurance rates.

ZEBRA INSURANCE SERIES

There is also a series of questions about what type of driving you do, if you work, how long you’ve been insured, and more. This includes providing your name, address, phone number, and email address, along with vehicle make, model, and year.

I took the plunge and signed up to see firsthand what it was all about.įirst, you tell them about yourself and your vehicle so they know more about your driving history and your insurance needs. The Zebra claims to make this process easier for insurance shoppers. There are a lot of companies in the insurance industry, and it can be difficult to find the right auto insurance provider for you. They refer to themselves as the “nation’s leading insurance search engine” with a real-time Z ebra insurance comparison engine at your fingertips. And it’s not unlike the process you’d go through with an individual carrier or broker. Should you try comparison shopping with the Zebra?.How do you find the right auto insurance coverage for your needs?.How can you unlock discounts on the Zebra?.

0 kommentar(er)

0 kommentar(er)